End of the Year Tax Alerts – Suriname

End of the Year Tax Alerts – Suriname

November 18, 2024

As the end of the year approaches, we would like to take this opportunity to provide you with some general information and updates on potential tax-saving strategies that can be implemented before year-end, as well as some practical tax advice to help you avoid any additional tax costs and properly prepare for the upcoming tax year.

1. Corporate Income Tax

Request for a lower 2025 taxable result – provisional income tax return 2025

The estimated taxable result of the provisional income tax return for 2025 should be equal to or greater than the taxable result of the most recently filed final income tax return. If you expect a lower taxable result for 2025 compared to the most recent final income tax return, it is necessary to submit a substantiated request by February 15, 2025. Failure to submit and/or have an approved request, and subsequently filing a lower provisional income tax return, may result in assessments that include penalties and interest charges.

Carry forward losses

In Suriname, tax losses can be carried forward for a maximum of seven years after the tax year involved. However, tax losses incurred during the initial period, which refers to the first three years after the establishment of a branch or company, can be carried forward for an indefinite period. This provision allows businesses to offset these losses against future taxable income, providing them with potential tax benefits in the long term.

Tax optimization – for example provisions

Tax optimization, also known as tax planning or tax efficiency, refers to the strategic management of financial affairs and transactions in order to minimize tax liabilities within the boundaries of the law. It involves utilizing tax deductions, exemptions and other strategies to reduce the overall tax burden on individuals and businesses. The goal of tax optimization is to maximize after-tax income or profits by employing various tax planning techniques while remaining compliant with tax regulations. It is important to note that tax optimization should be conducted ethically and in accordance with applicable tax laws and regulations.

An example of tax optimization is that a provision can be formed. Since provisions are accounted as expenses, they can lower the company’s profit, which in turn reduces tax liability. A provision may be formed for future expenditures:

- which are founded in the facts and circumstances that occurred during the period prior to the balance sheet date;

- which can also be attributed to the period; and

- which has a reasonable degree of certainty that the expenditures will occur.

Hereinafter some examples of provisions which may be applied and thus may have an impact on the tax liability of your company:

- a provision for pension liabilities;

- a provision for restructuring costs;

- a provision for maintenance costs; and

- a provision for product warranties.

We will be able to identify potential expenditures that could be accounted for as provisions.

Foreign exchange rate gains/losses

Dealing with foreign exchange gains and losses for tax purposes, can be complex. In recent years, Suriname has experienced significant fluctuations in exchange rates, which has had an impact on businesses. These fluctuations have led to both exchange gains and losses for businesses. It is important to note that when exchange gains are realized, they become taxable. On the other hand, even if not realized, exchange losses are deductible. This deduction helps to lower the taxable result for businesses affected by these fluctuations.

Online Income Tax Registration

Current Filing System: currently the Wage tax & Social security premium returns and the VAT returns must be submitted online through the online portal of the Tax Authority.

Changes Income Tax Returns in 2025: As of January 1, 2025, it is mandatory to submit income tax returns through the online portal of the Tax Authority.

To ensure compliance, clients need to register for income tax purposes through the Online Portal. It is now possible to register for income tax purposes.

Filing Deadlines and Requirements:

- Preliminary Income Tax Return for 2025: This return, which is due in April 2025, must be filed online. However, companies with a different fiscal year should review whether they also need to file their preliminary income tax return online. Based on current information, it appears that these companies may still be required to submit the return in hard copy. Additionally, companies with lower taxable income must file their return in hard copy as well, and obtain approval from the Tax Inspector.

- Final Income Tax Return for 2024 and Prior Years: These returns must still be submitted in hardcopy.

- Final Income Tax Return for 2025: This return, due in 2026, must be filed online.

The Tax Office is working to enhance the Online Portal to accommodate more features. Currently, the system amongst others lacks the functionality to file returns in other currencies.

Compliance up to year 2022

If there are outstanding compliance up to and including the year 2022, you have the option to rectify this without incurring any penalties or interest. However, please note that a special request must be submitted to the Tax Authorities in order to benefit from this opportunity.

We recommend addressing this matter promptly to ensure compliance and avoid any potential issues.

Personal Income Tax

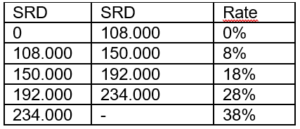

Starting January 1, 2024, the tax-deductible professional expenses that can be considered for tax calculations have been increased from SRD 1,200 to SRD 4,800 maximum per year. Additionally, the tax brackets have been revised. Below are the updated tax brackets that apply to personal income taxation:

2. Wage Tax

Wage Tax Scan

A wage tax scan ensures that payroll processes are fully aligned with the Wage Tax Act, Labor Act, and Social Security Premium Act. Non-compliance may lead to penalties or even legal actions, which can negatively impact your business.

A wage tax scan allows you to ensure that all applicable tax exemptions and deductions, such as those for vacation allowances, bonuses, or other fringe benefits, are correctly applied. This can help reduce the overall tax liability and improve the cash flow of your business.

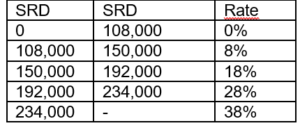

Updated tax brackets and tax-free amount

The tax-free amount currently amounts to SRD 108,000 per year (and SRD 9,000 per month). For the calculation of the wage tax, the tax-deductible professional expenses for calculation purposes, have been increased from SRD 1,200 to SRD 4,800 maximum per year (SRD 400 per month).

No additional Personal Income tax is levied when employment is a person’s sole source of income.

Below the latest tax brackets per year:

Vacation allowance and bonusses

In Suriname, employers are required to provide vacation allowances to their employees. In contrast, bonuses are not mandatory, though they can be offered as an incentive to motivate employees.

Both, holiday allowances and bonus payments are eligible for an exemption of SRD 10,016.

Severance payments

Employers are legally not obligated to provide severance payments to employees. However, it is a commonly adopted practice to prevent conflicts in employment termination situations. Employers need to keep detailed records of the termination process, including the reason for termination, severance payment amount, and any relevant agreements or contracts.

Furthermore, it is worth noting that severance pay can be subject to more advantageous tax treatment if a specific request is made.

Cost Allowances

There is an opportunity to optimize the wage structure of employees. According to the Wage Tax Act, cost allowances are excluded from the definition of wages and therefore not subject to taxation. However, it is important to have proper substantiation in place. The employer must be able to prove that these allowances are intended to cover necessary expenses directly associated with the performance of work duties. Examples of such tax-free allowances include representation allowance, transport allowance, and internet allowance. These allowances can be fixed and provided on a regular basis, taken into account the substantiation.

3. Increase of minimum hourly wage

In 2024, the minimum hourly wage has been increased to SRD 49,12 as of April 1st 2024. The prior minimum hourly wage was set on 35 SRD.

4. Increase of the contribution base pension

As of August 2023, the minimum pension contribution base under the General Pension Act has been increased to SRD 2,250 per month, while the maximum contribution base is now SRD 22,500 per month.

We would like to highlight, perhaps redundantly, that the pension premium under the General Pension Act will be 8% in 2025. Please note that insurance policies with regular insurers may have different terms. Nevertheless, all insurance policies should be in compliance with the General Pension Act.

5. Import duties exemption (partially or full)

As of December 28, 2023, with the issuance of Ministerial Decree L.a.F. no. 3394, entrepreneurs no longer need to submit a “no objection or clearance certificate” when applying for an exemption.

This change, part of a reform aimed at improving the efficiency and speed of services, applies to exemptions on import duties for business assets, raw materials, auxiliary materials, and packaging materials, as outlined in the 1997 Raw Materials Decree (S.B. 1997 no. 48, as last amended by S.B. 2021 no. 32).

Entrepreneurs can now submit exemption requests without providing the “clearance certificate”. However, this does not relieve the entrepreneur of their tax obligations. The Tax Authority will internally review the entrepreneur’s tax status after the exemption request is submitted.

Please consider the options available to you for importing goods with an exemption from import duties.

6. Extension Fiscal Jurisdiction

As of February 1, 2023, the Suriname’s fiscal jurisdiction over the Exclusive Economic Zone (EEZ) and the Continental Shelf Area became effective. With the implementation of this law, all applicable tax regulations now extend to the offshore area, including the EEZ. Consequently, offshore personnel and individuals are now subject to payroll tax and/or personal income tax.

7. Value Added Tax Act

VAT quick scan

VAT has been implemented as of January 1, 2023. Since its introduction, businesses (and even the Tax Authority) have faced several challenges. To mitigate uncertainties and ensure you meet all compliance requirements, a VAT scan (such as review of the invoices and filed VAT returns) can be included as part of the annual compliance check.

For instance, the VAT Act outlines exemptions, zero-rated activities, items taxed at 5%, and luxury goods taxed at 25%. It is crucial for companies to understand the VAT implications, including the proper settlement of Input VAT.

Application of a 5% VAT on several products

A 5% VAT should have been applicable on the following as of November 1, 2023:

- the supply of water and related services by a state enterprise or government service exclusively for domestic use, and other supplies of water in packaging of at least five gallons or more;

- the supply of electricity and related services;

- the supply of cooking gas; and

- domestic goods transportation by road, water, and air.

However, after several discussions and following an evaluation by the VAT Evaluation Committee, the VAT rates on water, electricity and cooking gas was not amended until July 1, 2024. And the VAT on fuel was increased from 5% to 10% on the same date.

Small entrepreneurs’ regulation

Certain small businesses are exempt from the obligation to register for VAT. Entrepreneurs residing or established in Suriname with a maximum annual revenue of SRD 1,000,000 are not required to comply with VAT obligations, including filing tax returns or paying VAT. However, please note that in this case, VAT paid on purchases (input VAT) cannot be recovered.

Entrepreneurs must register for VAT immediately once their revenue exceeds the SRD 1,000,000 threshold.

Fiscal Unity

Suriname does permit separate legal entities to be grouped for VAT purposes according to article 1 paragraph f(4), which states that the individuals and corporates who are entrepreneurs on the basis of the provisions of this paragraph and are established in Suriname or have a permanent establishment in Suriname and who are financially, organizationally and economically intertwined in such a way that they form a unit, at the request of one or more individuals or corporates, by decision of the Inspector will be treated as one entrepreneur effectively from the first day of the month, following that in which the Inspector issued that decision.

We do note that it is not specifically mentioned that a request should be made, however, recommend to do so, in order to avoid miscommunication with the Tax Authority.

Interest and penalties

Late filing of tax returns and failure to pay the amount due in June 2024 – for the month May 2024 – and onwards will incur penalties and interest. All outstanding returns for the taxable periods January 2023 to April 2024 had the opportunity until July 31, 2024, to file and pay/or arrange for payment of VAT without penalties and interest. After that date, penalties and interest will be strictly applied.

8. The Draft Investment Act 2024 – the renewal of the Investment Act 2001 ( SB 2002 no 42)

The draft Investment Act of 2024 introduces both tax and non-tax incentives, many of which were also included in the previous Investment Act of 2001. These changes aim to create a more favorable investment and business environment in Suriname. Non-tax incentives cover areas such as:

- Permits for foreign currency transfers;

- Residency and employment of foreign personnel;

- Business establishment and the import/export of goods and services;

- Assistance in obtaining exploration, exploitation, and concession rights, as well as land rights.

The majority of provisions are tax-related, including well-known incentives like accelerated depreciation, income tax exemptions, import duty exemptions on business assets, and exemptions from statistics duty. Other provisions, amongst others, investment allowances, horizontal loss offsets, and deductions for imputed interest on equity, have also been included.

Both Surinamese citizens and foreign investors can apply for these incentives.

We will provide further details once the Act is approved by Parliament.

9. Treaty Curaçao and Suriname

We are pleased to inform you that Suriname has signed a new Tax Treaty with Curaçao on July 1, 2024. This complements the existing tax treaties Suriname has with the Netherlands and Indonesia. Please note, the new treaty is still subject to ratification by both countries before it becomes effective.

In general, the key benefits of a tax treaty include several advantages for individuals and businesses in both countries, such as:

- Prevention of Double Taxation: The treaty ensures that individuals and businesses in Suriname and Curaçao are not taxed twice on the same income.

- Rules for Withholding Tax: Specific rules in the treaty about withholding taxes on dividends, interest, and royalties.

For example: Dividends paid by a resident of one treaty state to a resident of the other treaty state may be taxed in the latter state. However, the state of residence of the paying company may also tax dividends, but the tax should not exceed:

– 5% of the gross dividends if the recipient is a company owning at least 10% of the paying company’s capital.

– 10% of the gross dividends in other cases.

- Protection Against Discrimination: The treaty protects individuals and businesses from discrimination based on nationality or residency in matters of taxation, ensuring fair treatment and equal competitive conditions.

- Dispute Resolution Procedure: It establishes a procedure for bilateral consultation and dispute resolution between Suriname and Curaçao, facilitating effective and timely resolution of tax disputes.

- Promotion of Economic Cooperation: By reducing tax barriers and providing legal certainty, the treaty promotes economic cooperation and investment between Suriname and Curaçao, benefiting both economies.

It is crucial to understand how the provisions may affect your tax obligations and financial planning, if you are currently doing business in Suriname and Curaçao or are considering it.

10. FIN or fiscal identification number

All importers and exporters are required to use their Fiscal Identification Number (FIN) when processing transactions with the Customs and Excise Department. Registration for Customs purposes can now be done through the online portal.

The FIN will apply to all taxes, including Customs. No additional VAT number will be provided.

If you have any questions or need further assistance, please feel free to contact our Tax Department. Our experts are happy to assist you and ensure that you are fully informed about the new rules and how they will apply to your situation.