Aruba – Significant reduction in Income Tax rates

Aruba – Significant reduction in Income Tax rates

January 9, 2025

On January 7, 2025 the government of Aruba published the new progressive tax rates for the Income Tax 2025 in Aruba, leading to a significant reduction in the lower tax rates.

The government of Aruba has reviewed the impact of the most recent tax changes in the Tax Plan 2023 and the introduction of BBO/BAVP/BAZV upon import of goods and has concluded that the purchasing power of the residents of Aruba has been impacted more than expected. In line with the plans of the government to shift the burden of taxation from Direct Taxes to Indirect Taxes, the government has decided to adjust these effects by lowering the tax rates for the wage taxes and income taxes, whilst remaining the tax-free amount at Afl 30.000

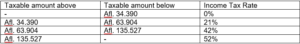

The progressive income tax rates will be adjusted as follows:

The implications of the changes are that any taxpayer with annual income of Afl. 64.390 will not be subject to wage tax or income tax and taxpayer with an annual income above that will only pay taxes on the income above the same threshold.

Please do note that social security contributions may apply on the tax-free or 0% taxed income components.

Contact

In case you wish to receive further information or discuss your tax position, kindly contact one of our advisors.