Budget Day 2024 – Caribbean Netherlands

Budget Day 2024 – Caribbean Netherlands

October 22, 2024

Every third Tuesday of September it is Budget Day in the Netherlands. On this day, the Dutch cabinet proposes its new financial, legal and tax plans to the House of Representatives. The islands Bonaire, St. Eustatius and Saba are so-called special municipals of the Netherlands (Caribbean Netherlands). This means that the Dutch cabinet also proposes its new plans for these islands on Budget Day. In this article, we will inform you about the new proposed Tax Plan 2024, which includes the plans for changes in BES Tax Act (including the Revenue Withholding Tax and Real Estate tax), the BES Income Tax Act, and the BES Wage Tax Act.

Proposals

Important to address is that the below plans announced on Budget Day still have to pass through the House of Representatives and the Senate (Tweede en Eerste Kamer), and only become official after publication in the Staatsblad or the Staatscourant.

BES Tax Plan 2025

According to the government the BES tax system needed a few additional changes following the earlier technical and structural changes in the legislation in the tax plan 2024. The changes include some technical changes which do not impact the tax position of the taxpayers in the BES, such as relocation of the wage components in the wage taxes to further align them with similar definitions in the Income Tax Act and changes in the required documentation in the BES Customs Law and additions to the formal identification requirements, which will not be highlighted in this news flash.

Income Tax – Tax rates and tax-free amount

The tax-free allowance is now legally linked to the minimum wage in the BES Income Tax Act. This measure was already introduced in 2024 and is now being formalized. The tax-free allowance for 2025 is currently set at USD 20,424 but may change if the minimum wage is adjusted later in the year as of January 1, 2025.

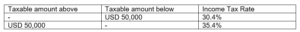

The progressive income tax rates will be adjusted as follows:

The proposed changes lower the tax bracket for the 35.4% tax rate from USD 322,679 to USD 50,000 of the taxable income after deduction of the tax-free amount.

Income Tax – Main Residence

The definition of main residence in the BES Income Tax Act will be changed to include the words “which is, other than temporarily, available to the taxpayer as a primary residence”. The Explanatory Notes state that the inclusion of these wording clarifies any possible misconceptions around the main residence for which a taxpayer is allowed to deduct the interest on the mortgage law and which property is exempt from Real Estate Tax.

Apparently, the legislator was of the opinion that the previous definition led to the possibility of taxpayers deducting interest on multiple properties they would own in the Caribbean Netherlands.

Revenue Tax

The tax rate of the revenue tax, due on profit distributions gained from entities resident in the Caribbean Netherlands, will be increased from 5% to 7.5%. The Explanatory Notes specifically state that there will be no transitional arrangement and/or lower tax rate for any retained profits earned before January 1, 2025 due to the administrative burden, complexity of such transition calculation and the limited increase in the tax rate. The income tax payable in the BES Income Tax Act on these distributions by individual shareholders or participants will also be increased from 5% to 7.5%.

Real Estate Tax – Tax rates

Real Estate Tax is levied from a person or entity that has ownership, possession, or a limited right to a real property in Bonaire. The deemed return on the real property is calculated as 4% of the value of the property and taxed against a flat rate of 17.5%. The special tax rate for hotels owned by entities (not individual owners) will be increased from 10% to 11%.

Real Estate Tax – Investment exemptions

If the value of a real property increases due to construction, renovation, improvement, expansion, or refurbishment, this increase in value will only be taken into account starting from the eleventh year after the year in which the increase in value occurred, which means that effectively the increase in value is exempt for a period of 10 years.

For increases in value as described above as of January 1, 2025 and onward the exemption will only apply for a period of 5 years.

Wage Tax – Market Value Salary

The Tax Plan BES 2025 further formalizes the fact that the partner of the director-shareholder will also be subject to the rules for market value salaries, provided that the partner performs activities for the entity in which the director-shareholder holds their shares and is a director. The partner does not have to be a director of the company.

Furthermore, the rules that the income of the directors-shareholder or its partner should be at least 90% of the amount any other employee earns or 90% of the net turnover do not apply if the income will fall below the minimum threshold of twice the tax-free amount as due to this adjustment.

Wage Tax – Identification employees

The Tax Plan BES 2025 also further formalizes the requirements for identification of employees and further stipulate the existing practice that when the employee is not identified correctly, their wages will be taxed against the highest tax rate in the Income Tax and Wage Taxes.

Wage Tax – Final Levy

The legislation regarding the final levy is further amended in the Tax Plan BES 2025. A final levy occurs when the employer provides for payment of wage taxes without further withholding these wage taxes upon individual employees, mostly because the income components are administratively difficult to individualize.

In the final levy, the employer becomes the taxpayer and not just withholding agent, and the income components need to be grossed up. The final levy also includes the social security and employers’ insurance premiums. The tax authorities will be providing tables to alleviate the administrative burden upon imposing the final levy.

Contact

In case you wish to receive further information or discuss your tax position, kindly contact one of our advisors.