End of the Year Tax Alerts – Caribbean Netherlands (Bonaire, Saba and Sint Eustatius)

End of the Year Tax Alerts – Caribbean Netherlands (Bonaire, Saba and Sint Eustatius)

November 19, 2024

With the end of the year approaching, we would like to take this opportunity to offer you some general information about possibilities for tax savings which may be implemented before the end of the year as well as some general tax advice to avoid any additional tax costs by preparing you for the end of the tax year. [1]

Revenue Tax

The revenue tax rate applicable to profit distributions from entities resident in the Caribbean Netherlands will be increased from 5% to 7.5%. It is important to note that no transitional arrangements will be implemented for retained profits earned prior to January 1, 2025. Therefore, any distributions of retained earnings provided for after January 1, 2025 will be taxed against the higher tax rate of 7.5%, regardless of the basis of these retained earnings. Additionally, the income tax levied on such distributions by individual shareholders or participants will also increase from 5% to 7.5%.

Wage Tax

Cost Allowances

Under certain circumstances it is possible to provide tax-free cost allowances to staff members. Examples of these cost allowances include:

- phone allowance;

- reimbursement of study costs;

- travel expenses including a daily allowance for meals;

- representation costs;

- costs for the workspace at home.

Please note that the employer, if desired, can, under certain circumstances, make tax-free contributions to the pension plan of the staff members.

Optimizing the cost allowances taking into account the conditions set in the tax law, may lead to significant tax savings.

Benefits in kind valuation

If an employer provides benefits in kind, these benefits are considered taxable wages. However, under circumstances, the prescribed method to calculate the benefit of the use of certain company assets, such as a car or a house or even a company meal, can lead to tax savings for the employer and employee.

Optimizing the salary package with benefits in kind may lead to tax savings.

Expatriate ruling and administration

Additional tax-free allowances and other benefits are available for employees who have not worked in the Caribbean Netherlands for a period of at least 5 years and will earn at least USD 83,500 per year.

These benefits include:

- tax free allowance for school fees;

- tax free fringe benefits up to USD 8,380 per year;

- tax free allowances for the removal costs, the additional costs for housing in the first months and a rental car in the first months.

Additionally, the employer and employee can agree upon a net wage contract. The wage tax will then be calculated on the net wages and not be grossed up. Applying for the expatriate ruling can allow for a more competitive offering to potential candidates overseas.

Salary of the director-shareholder

Director-shareholders are obliged to take into account a fair market salary (in Dutch: gebruikelijk loon) for their services to the company in which they hold at least 5% of the shares.

The market salary should be determined by the highest of the following:

- 90% of the wages earned in the most comparable employment situation;

- the salary of the employee that earns the most without having shares in the company or if no employees are working in the company or affiliated entities 90% of the net turnover;

- twice the tax-free allowance as defined in article 24 of the Income Tax Act.

Please note that the legislation allows for a taxpayer to deviate from these conditions if the taxpayer can substantiate that the amount calculates above is higher that 90% of the wages earned in the most comparable employed situation, the lower amount may be taken into account. It is essential to ensure that the salary of the Director-Shareholder is accurately calculated and that any discrepancies from the rules above are adequately substantiated in writing.

The Tax Plan BES 2024 further formalizes per January 1, 2025 the fact that the partner of the director-shareholder will also be subject to the rules for market value salaries, provided that the partner is working in employment for the entity or an entity in the group owned by the director-shareholder. The partner does not have to be a director of the company for the market salary rules to apply.

Reconciliation of wages

It is important to ensure that the wage tax summary and the wage costs in the annual accounts are reconciled and accounted for to avoid corrections and penalties in the future.

The Tax Plan BES 2025 formalizes further requirements for the identification of employees, including a burden of proof shifting towards the employer if they knew or should have known the identification documents were incorrect. In cases where employee identification is inaccurate, their wages will be subject to the highest applicable income tax and wage tax rates.

Final Levy

The Tax Plan BES 2025 also refines the regulations pertaining to the final levy. A final levy is applicable when an employer pays wage taxes without withholding them from individual employees, often due to the complexity of individualizing income components.

Under a final levy, the employer assumes the role of taxpayer, and the income components must be grossed up. Additionally, the final levy includes social security and employer insurance premiums. To mitigate the administrative burden, the tax authorities will provide supporting tables.

General Expenditure Tax (in Dutch: Algemene Bestedingsbelasting / ABB)

Refund of input ABB for manufacturers

The ABB allows for manufacturers to receive a refund of the ABB charged to them by other manufacturers or on import of goods when these goods are used by the manufacturer as raw materials or semi-finished products to produce their products.

Please note that refunds are only allowed if the invoices and import documents are prepared according to the prescribed format and the documents are available in the administration of the manufacturer. It is important to ensure all input ABB has been refunded.

Combination of services and supplies, what rate to use?

A lot of services provided are a combination of supply of goods and provision of services. For instance, the repair of a boat demands goods as well as the installation of these goods, installing a new bathroom is a combination of supply of goods and services and even the delivery of food by restaurants is a combination of both supply of goods and services.

Since the supply of goods is only taxable when provided by a manufacturer, but taxed at a higher rate, it is important to verify whether the correct taxation of the combination of services and supplies has been applied and whether an entrepreneur should be considered a manufacturer.

While each component of a combined supply should ideally be considered on a standalone basis, even if the combination is charged in one price, the overall transaction may be taxed based on the predominant element if the average consumer cannot readily distinguish between the goods and services, the combination of supply of goods and services is closely related and both components do not have a purpose on their own. Therefore, it is essential to determine whether the provision of goods or services constitutes the primary component.

To avoid additional taxation at a later stage it is important to assess the tax returns for the application of all combinations of supply of goods and provision of services prior to the end of the year.

Refunds on ABB from bad debts and discounts

Please note that the ABB will be refunded upon invoices that are not (fully) paid and which will not be paid in full, as well as with regard to discounts provided on invoices.

It is important to check before the end of the year if a refund has been requested for all discounted invoices and bad debts.

Cost sharing agreements

The legislation ABB does not have the possibility for affiliated entities to join in a so-called fiscal unity to avoid ABB on intercompany transactions. However, when a group of affiliated companies have certain expenses that are incurred by one entity, but have been used by multiple entities, a cost sharing agreement may provide a solution to avoid ABB-taxation on intercompany transactions.

A cost sharing agreement is a pre-defined legal agreement that outlines how a group of entities will share the costs of shared services or intangibles. The allocation of costs is typically determined based on the utilization of these services by the participating entities. Since the allocation of the costs has to be pre-defined it is important to ensure that the agreement has been entered into and the allocation key has been provided for before the year-end.

Small Business Exemption

The small business scheme is regulated in article 6.22 of the Tax Law BES. In short, the scheme means that the ‘small entrepreneur’ who is eligible for this scheme does not have to file an ABB return and does not have to pay the ABB in that year, the entrepreneur receives an exemption for this.

To be eligible for the small business schemes, the following conditions must be met (in short):

- the entrepreneur is a natural person and lives in the Caribbean Netherlands or is located in the Caribbean Netherlands or has a permanent establishment in the Caribbean Netherlands;

- the natural person in question is the owner of a company (sole proprietorship);

- the annual turnover does not exceed the threshold of USD 20,000 (which is proposed to be increased to USD 30,000 in the Tax Plan 2024).

- if the entrepreneur has more than one business or exercises more than one profession, the companies or professions will be taken into account jointly for the purposes of this regulation.

- the entrepreneur needs to provide periodic updates on their turnover to the tax authorities.

If during the calendar year the turnover threshold of USD 20,000 is exceeded, the ‘small entrepreneur’ is obliged to file and pay an ABB return for the amount due over that year, which needs to be filed with the first tax return in the year following the year the threshold is exceeded.

Personal Income Tax

Increase of the tax-free allowance for personal income tax

The tax-free allowance for Income Tax purposes is now formally linked to the minimum wage. The tax-free allowance for 2025 is currently set at USD 20,424 but may change if the minimum wage is adjusted later in the year as of January 1, 2025.

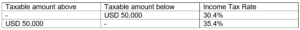

The progressive income tax rates will be adjusted as follows:

The proposed changes lower the tax bracket for the 35.4% tax rate from USD 322,679 to USD 50,000 of the taxable income after deduction of the tax-free amount.[2]

Main Residence

As of 2025, the definition of “main residence” in the BES Income Tax Act will be amended to include the requirement that the property must be “primarily available to the taxpayer as a residence”. This clarification aims to address concerns about taxpayers potentially deducting interest on multiple properties in the Caribbean Netherlands. Interest paid on loans secured by the main residence is deductible from the taxable income for Personal Income Tax purposes up to an amount of USD 15,364. Additionally, the premiums for fire and natural disaster insurances, as well as maintenance costs up to USD USD 1,676 or 2% of the property’s value, are deductible.

To maximize deductions, it is recommended to spread out maintenance costs over multiple years.

Cost Deduction for Study and Children

The costs for study for a job and the costs for study and necessary cost of living for children can be deductible from the taxable income for Personal Income Tax purposes.

It is important to not just keep the invoices of these costs, but also the proof of payment, since for deduction purposes you need to prove you have paid the expenses.

Real Estate Tax

The Real Estate Tax rate for individuals and entities owning real property in Bonaire remains at 17.5%, calculated based on 4% of the property’s value. However, the special tax rate for hotels owned by entities will increase from 10% to 11%.

Exemption for increase in value due to construction

Increases in property value due to construction, renovation, improvement, expansion, or refurbishment will be exempted from taxation for 10 years starting from the eleventh year after the increase occurs. For increases occurring on or after January 1, 2025, the exemption period will be reduced to 5 years. It is important to request for the exemption to apply for any increases in the value as per December 31, 2024 to ensure the 10-year-period will apply.

[1] Please note that we have included the proposed measures in the Tax Plan 2025 in this tax alerts. This plan is still pending approval of Senate in the Netherlands.

[2] Please note that Parliament in the Netherlands has proposed to postpone the changes in this paragraph to January 1, 2026.