End of the Year Tax Alerts – Suriname

End of the Year Tax Alerts – Suriname

December 1, 2025

As the end of the year approaches, we would like to take this opportunity to provide you with some general information and updates on potential tax-saving strategies that can be implemented before year-end, as well as some practical tax advice to help you avoid any additional tax costs and properly prepare for the upcoming tax year. To conclude this year’s edition, we would also like to shed some light on key taxation aspects of the booming oil & gas, tourism and agriculture sectors in Suriname.

- Corporate income tax

Request for a lower 2026 taxable result – provisional income tax return 2026

The estimated taxable result of the provisional income tax return for 2026 should be equal to or greater than the taxable result of the most recently filed final income tax return. If you expect a lower taxable result for 2026 compared to the most recent final income tax return, it is necessary to submit a substantiated request by February 15, 2026. Failure to submit and/or have an approved request, and subsequently filing a lower provisional income tax return, may result in assessments that include penalties and interest charges.

Carry forward losses

In Suriname, tax losses can be carried forward for a maximum of seven years after the tax year involved. However, tax losses incurred during the initial period, which refer to the first three years after the establishment of a branch or company, can be carried forward for an indefinite period. This provision allows businesses to offset these losses against future taxable income, providing them with potential tax benefits in the long term.

Online Income Tax Registration & Filing

Starting January 1, 2025, income tax returns must now be filed through the Tax Authority’s official online portal. This new requirement applies to both individuals and businesses, marking a major step toward digital efficiency and compliance.

To ensure compliance, clients need to register for income tax purposes through the Online Portal. Whether you’re an entrepreneur, employee, or corporate taxpayer — make sure you’re ready to transition to the online system. Avoid penalties and stay compliant.

Filing Deadlines and Requirements:

- Preliminary Income Tax Return for 2026: This return, which is due in April 2026, must be filed online.

- Final Income Tax Return for 2025, which is due June 30, 2026 for entities and April 30, 2026 for individuals, must be filed online. The Final Income Tax Return for prior years however must still be submitted in hardcopy.

- Final Income Tax Return for 2026: This return, due in 2027, must be filed online.

The Tax Office is working to enhance the Online Portal to accommodate more features. Currently, the system amongst others lacks the functionality to file returns in currencies other than the SRD.

- Personal income tax

Stay ahead this tax season with these practical strategies to optimize your returns and stay compliant:

- Track deductible expenses (e.g. mortgage interest, outdoor painting expenses and education expenses):

- Use tax brackets wisely: Spread income or bonuses to stay in lower tax brackets if possible.

- Insofar as wage is the sole source of income, no Income Tax assessment will follow.

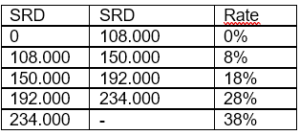

Below you will find the regular tax brackets on a yearly basis that apply to personal income taxation:

3. Wage Tax

Wage Tax Scan

A Wage Tax Scan provides a comprehensive review of your payroll processes to ensure full compliance with the Wage Tax Act, Labor Act, and Social Security Premium Act. This proactive approach helps mitigate the risk of non-compliance, thereby avoiding potential penalties or legal consequences.

The scan also verifies the correct application of tax exemptions and deductions, including those related to vacation allowances, bonus payments, and other fringe benefits — contributing to a reduced tax liability.

In recent years, the Wage Tax Act has undergone several significant changes as part of the government’s initiative to create a more balanced and efficient fiscal framework. These updates are aimed at reducing tax pressure on salaries and realigning allowances and overtime compensation with today’s economic realities. These changes are among others:

- An increase in tax-exempt amounts for holiday allowances and bonus payments

- Revision of the overtime tax brackets.

Current regular tax brackets and tax-free amount

The tax-free amount currently amounts to SRD 108,000 per year (and SRD 9,000 per month). For the calculation of the wage tax, the tax-deductible professional expenses for calculation purposes remains at SRD 4,800 maximum per year (SRD 400 per month). No additional Personal Income tax is levied when employment is a person’s sole source of income.

Below you will find the current tax brackets:

Vacation allowance and bonuses

In Suriname, employers are required to provide holiday allowances to their employees. By contrast, bonuses are not mandatory, though they can be offered as an incentive to further motivate employees. Nevertheless, both the holiday allowance and the bonus are tax-free up until a certain amount.

As of January 2025, these amounts have increased from SRD 10.016 to SRD 19.500 each. This has an effect on the computation of the wage for wage tax purposes, as well as the wage for the computation of the premium pursuant to the General Old Age Provision Act.

Revisions of overtime tax brackets

Overtime is the work performed by an employee, on the instructions of or with the permission of the employer, in compliance with applicable regulations, outside of the working schedule established for the employee.

As of July 1st 2025, the tax treatment of overtime compensation has been adjusted. The new monthly tax brackets for overtime pay are:

- Up to SRD 2.500: 5%;

- Between SRD 2.500 and SRD 7.500: 15%

- Above SRD 7.500: 25%.

The reduced tax burden on overtime serves as a strong incentive for employees to work additional hours. Employers must update how they track and calculate overtime pay to ensure that the correct amount is withheld for wage tax purposes.

Severance payments

Employers are not legally required to provide severance payments to employees. However, it is a widely adopted practice to help prevent disputes during the termination of employment. To ensure compliance, employers should maintain detailed records of the termination process, including the reason for dismissal, the severance amount, and any relevant agreements or contractual terms. Additionally, severance payments may benefit from more favorable tax treatment if a specific request is submitted.

Cost Allowances

There’s an opportunity to enhance your wage structure and reduce tax pressure through smart payroll planning. Under the Wage Tax Act, certain cost allowances — such as representation, transport, and internet — are excluded from taxable wages, provided they are properly substantiated.

To qualify, these allowances must cover necessary work-related expenses, and employers must be able to substantiate their purpose. When correctly documented, these tax-free benefits can be fixed and paid regularly, helping lower overall tax liability.

- Increase of minimum hourly wage

In 2025, the minimum hourly wage has increased to SRD 52,47 as of April 1st 2025. The prior minimum hourly wage was set on SRD 49,12.

- Increase of the contribution base pension – General Pension Act 2014

As of 2023, the minimum pension contribution base under the General Pension Act (hereinafter “the Act”) has been increased to SRD 2,250 per month, while the maximum contribution base is now SRD 22,500 per month.

We would like to highlight that the pension premium under the Act will be 8.5% in 2026.

Please note that pension insurance policies offered by private insurers may include terms that differ from those outlined in the Act such as contributions levels and premium. Despite these variations, all pension-related insurance products must comply with the minimum legal standards set by the Act.

- Import duties exemption (partially or full)

To stimulate investment and economic growth, Suriname grants partial exemptions on import and statistical duties for various sectors, among others tourism, agriculture, and industries. The main provisions include:

- 50% exemption on import duties for business assets (with the remaining 50% payable);

- Partial exemption on statistical duties up to SRD 1,000; and

- For companies in the production sector, a 75% exemption on import duties applies (25% payable).

In order to claim this exemption, several formalities need to be met prior to the arrival of the goods in Surinamese ports.

Kindly note that according to the Ministerial Decree La.F.no. 1378, these partial exemptions of import tariffs are valid until June 27th 2026.

- Value Added Tax Act

VAT quick scan

A VAT scan is essential for businesses in Suriname to stay compliant and financially efficient under the new VAT regime introduced on January 1, 2023. Here’s why:

- VAT Rates: The VAT Act has multiple rates — 0%, 5%, 10%, and 25%;

- Exemptions: Certain goods and services are VAT-exempt, which has direct implications for input VAT recovery; and

- Zero-Rated Supplies: Supplies to (sub)contractors in the oil & gas sector will qualify for the 0% rate.

Input VAT Recovery Rules

- Recoverable: Input VAT is deductible when the corresponding output supply is taxed, regardless of whether it’s at 0%, 5%, 10%, or 25%; and

- Non-Recoverable: If the output supply is VAT-exempt, input VAT cannot be recovered.

- For example, a supplier making zero-rated supplies (e.g., to oil & gas contractors) can deduct input VAT.

- However, if the supply is exempt, no input VAT deduction is allowed.

Small entrepreneur’s scheme

Small businesses in Suriname with an annual revenue of SRD 1,000,000 or less are exempt from VAT registration. This means they are not required to file VAT returns or charge VAT on their sales.However, it’s important to note:

- Input VAT on purchases cannot be recovered under this exemption; and

- Once revenue exceeds SRD 1,000,000, entrepreneurs must register for VAT immediately and comply with all related obligations.

This threshold offers administrative relief for micro and small enterprises, but businesses should monitor their revenue closely to avoid non-compliance.

Fiscal Unity

Suriname does permit separate legal entities to be grouped for VAT purposes according to article 1 paragraph f(4), which states that the individuals and corporations who are entrepreneurs on the basis of the provisions of this paragraph and are established in Suriname or have a permanent establishment in Suriname and who are financially, organizationally and economically intertwined in such a way that they form a unit, at the request of one or more individuals or corporations, by decision of the Inspector will be treated as one entrepreneur effectively from the first day of the month, following that in which the Inspector issued that decision.In order to avoid potential miscommunications with the Tax Authorities, we recommend to file a request to apply for the Fiscal Unity.

8. FIN or fiscal identification number

All importers and exporters are required to use their Fiscal Identification Number (“FIN”) when processing transactions with Customs. Registration for Customs purposes can now be done through the online portal.

The FIN will apply to all taxes, including Customs. No additional VAT number will be provided.

9. Key taxation aspects of the booming sectors of the Surinamese economy

Oil & gas sector

The oil and gas sector provides a wide array of tax incentives for (foreign) investors active in this sector. The main incentives worth pointing out are:- Exemption from import and export duties;

- Exemption for household goods of personnel;

- Exemption of dividend-withholding tax; and

- Zero rate for supplies to (sub)contractors for VAT-purposes.

Explore key insights on oil & gas taxation in Suriname in an article by Nazna Ishaak, featured in the 63rd edition of the VES publication.

Tourism and agriculture

Suriname provides a range of fiscal incentives aimed at encouraging foreign investment in priority sectors such as tourism and agriculture. Key advantages include:- Reduced import duties on eligible equipment and materials;

- Accelerated depreciation allowances for qualifying assets; and

- Tax holidays of up to nine years for approved projects.

These measures are intended to ease market entry, enhance profitability, and foster sustainable economic growth in Suriname.

10. Outline difference between Branch and a Legal Entity

Branch of public limited company?

(Foreign) investors seeking to establish a presence in Suriname must decide between setting up a public limited company ( in Dutch: “naamloze vennootschap”) or operate through a branch of their foreign parent company. Both structures are legally recognized, but differ in legal status, terms of liability, and regulatory obligations.

A public limited company is a legal entity that exists independently of its shareholders. It’s advantages from a legal point of view are:

- Offers limited liability protection for shareholders;

- Recognized as fully independent legal entity, making contracts, licenses, and local operations more straightforward; and

- Greater access to capital markets.

A branch of a foreign company is not a separate legal entity; it acts as an extension of the foreign parent company. It’s advantages are:

- Faster registration process and fewer administrative steps; and

- Suitable for temporary projects or market exploration.

The decision between establishing a Branch or a Limited Liability Company (NV) in Suriname will depend on several practical considerations — including your desired speed of market entry, administrative capacity, and long-term business strategy.

- A Branch offers a faster setup (approximately 3 to 6 weeks), minimal documentation, and no dividend withholding tax — making it ideal for short-term projects or exploratory operations.

- An NV, while requiring more time (around 3 to 6 months) and documentation, provides full legal independence and may be better suited for long-term investments or deeper local integration.

Both structures are subject to the same income tax-, VAT-, and wage tax rates under Surinamese law. However, the dividend tax treatment differs, with branches being exempt and NV’s being subject to 25%, potentially reduced to 7.5% under the Suriname–Netherlands tax treaty.

11. Tax Treaty Suriname–Curaçao

At the time of writing, news reports announced that the tax treaty with Curaçao has been submitted to the Curaçao and Dutch parliaments for approval. It is not yet known when the treaty will be presented to Suriname’s National Assembly. We will continue to keep you informed about developments, explain their implications for your business, and explore the possibilities this treaty may create for doing business across Curaçao and Suriname.

12. Bilateral Investment Treaty (BIT) between Suriname and the Netherlands, Aruba, Curacao, Sint Maarten and the Caribbean Netherlands

In the context of doing Business in Suriname, the BIT between Suriname and the Netherlands provides legal certainty and protection for investors from both countries. It ensures fair treatment, safeguards against expropriation without compensation, and allows disputes to be resolved through international arbitration. By offering these guarantees, the BIT encourages cross‑border investment, strengthens economic cooperation, and supports sustainable development. Article 13 extends the BIT’s scope to Aruba, Curacao, Sint Maarten and the Caribbean Netherlands, unless limited by a notification under Article 14(1), ensuring investors enjoy equal protections across these territories.

13. The Draft Investment Act 2024 – the renewal of the Investment Act 2001 ( SB 2002 no 42)

The draft Investment Act of 2024 introduces both tax and non-tax incentives, many of which were also included in the previous Investment Act of 2001. These changes aim to create a more favorable investment and business environment in Suriname. Non-tax incentives cover areas such as:

- Permits for foreign currency transfers;

- Residency and employment of foreign personnel;

- Business establishment and the import/export of goods and services;

- Assistance in obtaining exploration, exploitation, and concession rights, as well as land rights.

The majority of provisions are tax-related, including well-known incentives like accelerated depreciation, income tax exemptions, import duty exemptions on business assets, and exemptions from statistics duty. Other provisions, amongst others, investment allowances, horizontal loss offsets, and deductions for imputed interest on equity, have also been included.

Both Surinamese citizens and foreign investors can apply for these incentives.

We will provide further details once the Act is approved by Parliament.

14. Final note

Finally, we would like to refer you to the following link, where Nazna Ishaak provides extensive considerations on the Surinamese taxation system in a discussion on the future developments in the Surinamese tax sector.

If you have any questions or need further assistance, please feel free to contact our Tax Department. Our experts are happy to assist you and ensure that you are fully informed about the rules and how they will apply to your situation.