End of the Year Tax Alerts – Suriname

End of the Year Tax Alerts – Suriname

December 7, 2023

With the end of the year approaching, we would like to take this opportunity to offer you some general information about possibilities for tax savings which may be implemented before the end of the year as well as some general tax advice to avoid additional tax costs by preparing you for the end of the tax year.

- Corporate Income Tax

Request for a lower 2024 taxable result – provisional income tax return 2024

It is important to note that the estimated taxable result of the provisional income tax return for 2024 should be equal to or greater than the taxable result of the most recently filed final income tax return. If you expect a lower taxable result for 2024 compared to the most recent final income tax return, it is necessary to submit a substantiated request by February 15, 2024. Failure to submit and/or have an approved request, and subsequently filing a lower provisional income tax return, may result in assessments that include penalties and interest charges.

Carry forward losses

In Suriname, tax losses can be carried forward for a maximum of seven years after the tax year involved. However, tax losses incurred during the initial period, which refers to the first three years after the establishment of a branch or company, can be carried forward for an indefinite period. This provision allows businesses to offset these losses against future taxable income, providing them with potential tax benefits in the long term.

Tax optimization – for example provisions

Tax optimization, also known as tax planning or tax efficiency, refers to the strategic management of financial affairs and transactions in order to minimize tax liabilities within the boundaries of the law. It involves utilizing tax deductions, exemptions and other strategies to reduce the overall tax burden on individuals and businesses. The goal of tax optimization is to maximize after-tax income or profits by employing various tax planning techniques while remaining compliant with tax regulations. It is important to note that tax optimization should be conducted ethically and in accordance with applicable tax laws and regulations.

An example of tax optimization is that a provision can be formed. A provision may be formed for future expenditures:

- which are founded in the facts and circumstances that occurred during the period prior to the balance sheet date;

- which can also be attributed to the period; and

- which has a reasonable degree of certainty that the expenditures will occur.

Hereinafter some examples of provisions which may be applied and can have an impact on the tax liability of your company:

- a provision for pension liabilities;

- a provision for restructuring costs;

- a provision for maintenance costs; and

- product Warranties.

Foreign exchange rate gains/losses

In recent years, Suriname has experienced significant fluctuations in exchange rates, which has had an impact on businesses. These fluctuations have led to both exchange gains and losses for businesses. It is important to note that when exchange gains are realized, they become taxable. On the other hand, even if not realized, exchange losses are deductible. This deduction helps to lower the taxable result for businesses affected by these fluctuations.

Upcoming changes in the Income Tax Act and Dividend Tax Act

According to a draft law, as of January 1st, 2024, a new paragraph will be added to Article 9 of the Income Tax Act: with regard to natural persons residing in Suriname, the revenues they receive from public limited liability companies, limited partnerships with shares and other companies established in Suriname, whose capital is wholly or partly in shares and whose profit is derived for more than 75% from the business activities, will not be considered income for tax purposes. If this change is implemented in January 2024, individuals will no longer be required to declare this revenue.

2. Wage Tax

Upcoming changes of the tax brackets and tax-free sum

The tax-free sum at this moment amounts to SRD 90,000 per year (and SRD 7,500 per month).

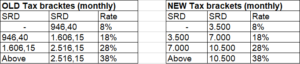

However, on November 23rd, some trade unions reached a consensus with the government on several tax measures. The parties agreed to amend the Wage and Income Tax Act. One significant aspect of this agreement is the adjustment of tax brackets within both acts. Although an official decree has not yet been issued, it is expected that changes will take effect as of January 2024. In line with this, the government has committed to implement the following modifications to the Income Tax Act and the Wage Tax Act:

- The monthly tax-free sum of SRD 7,500 will increase to SRD 9,000.

- The tax deduction (tax deductible expenses) will increase from SRD 100 to SRD 400; and

- The tax brackets will also be adjusted as follows:

Vacation allowance

In Suriname, employers are required to provide vacation allowances to their employees. However, it is important to note that bonuses are not mandatory. As per the Wage Tax Act, both holiday allowances and bonus payments are eligible for an exemption of SRD 10,016.

Severance payments

Employers are legally not obligated to provide severance payments to employees. However, it is a commonly adopted practice to prevent conflicts in employment termination situations. Furthermore, it is worth noting that a severance pay can be subject to more advantageous tax treatment if a specific request is made.

Cost Allowances

There is an opportunity to optimize the wage structure of employees. According to the Wage Tax Act, cost allowances are excluded from the definition of wages and therefore not subject to taxation. However, it is important to have proper substantiation in place. The employer must be able to prove that these allowances are intended to cover necessary expenses directly associated with the performance of work duties. Examples of such tax-free allowances include representation allowance, transport allowance, and internet allowance. These allowances can be fixed and provided on a regular basis, taken into account the substantiation.

- Increase of minimum hourly wage

In 2023, the minimum hourly wage has been increased two times. From March through June, it was set on SRD 30,-. From July through December, the minimum hourly wage amounts to SRD 35,-.

- Increase of the contribution base pension

As of August 2023, the minimum contribution base pension has been increased to SRD 2,250,- per month. The maximum contribution base amounts now SRD 22,500,- per month. These amounts will be applicable retroactively as per January 2023.

- Import duties exemption (partially or full)

The Minister of Finance and Planning may grant an exemption of import duties (fully or partially) on amongst other business assets, (raw) materials, goods or equipment, under various conditions. A special request should be filed. In some cases, the VAT may also be exempt.

- Extension Fiscal Jurisdiction

As of February 2023, Suriname’s fiscal jurisdiction over the area of the Exclusive Economic Zone (EEZ) and the Continental Shelf Area is confirmed. With the effectuation of this Law, all relevant tax laws have become applicable to the offshore area, including the Exclusive Economic Zone. This means amongst other that offshore personnel/individuals have become subject to payroll tax and/or personal income tax.

- Value Added Tax Act

VAT quick scan

We recommend performing a VAT quick scan for the VAT impact of the company, including amongst other the assessment of invoices and applicable rates. The most recent changes to the VAT have been made in September 2023. These changes refer to the applicable rates, and the change in the appendices of the VAT. The VAT Act has a list with exemptions, zero-rated activities, a list taxed at a rate of 5% and a list of luxury supplies taxed at a rate of 25%. It is therefore important that companies understand the impact that VAT will have on them, including the settlement of the Input VAT. This, in order to comply with their administrative and tax obligations.

Small entrepreneurs’ regulation

Certain small entrepreneurs are exempt from the requirement to register. The entrepreneur living or established in Suriname who has a revenue of one million Surinamese dollars (SRD 1,000,000) or less per calendar year in Suriname is exempted from the compliance obligations, including filing a tax return and paying tax. The entrepreneur needs to register immediately for VAT when the revenues exceed the threshold of SRD 1,000,000.

Fiscal Unity

Suriname does permit separate legal entities to be grouped for VAT purposes according to article 1 sub f(4), which mentions that the individuals and corporates who are entrepreneurs on the basis of the provisions of this paragraph and are established in Suriname or have a permanent establishment in Suriname and who are financially, organizationally and economically intertwined in such a way that they form a unit, at the request of one or more individuals or corporates, by decision of the Inspector will be treated as one entrepreneur effectively from the first day of the month, following that in which the Inspector issued that decision.