End of the Year Tax Tips – Caribbean Netherlands (Bonaire, Saba and Sint Eustatius)

End of the Year Tax Tips – Caribbean Netherlands (Bonaire, Saba and Sint Eustatius)

November 19, 2025

With the end of the year approaching, we would like to take this opportunity to offer you some general information about possibilities for tax savings which may be implemented before the end of the year as well as some general tax advice to avoid any additional tax costs by preparing you for the end of the tax year. [1]

Wage Tax

Cost Allowances

Under certain circumstances it is possible to provide tax-free cost allowances to staff members. Examples of these cost allowances include:

- phone allowance;

- reimbursement of study costs;

- travel expenses including a daily allowance for meals;

- representation costs;

- costs for the workspace at home.

Please note that the employer, if desired, can, under certain circumstances, make tax-free contributions to the pension plan of the staff members.

Optimizing the cost allowances taking into account the conditions set in the tax law, may lead to significant tax savings.

Benefits in kind valuation

If an employer provides benefits in kind, these benefits are considered taxable wages. However, under circumstances, the prescribed method to calculate the benefit of the use of certain company assets, such as a car or a house or even a company meal, can lead to tax savings for the employer and employee.

Optimizing the salary package with benefits in kind may lead to tax savings.

Expatriate ruling and administration

Additional tax-free allowances and other benefits are available for employees who have not worked in the Caribbean Netherlands for a period of at least 5 years and will earn at least USD 83,500 per year.

These benefits include:

- tax free allowance for school fees;

- tax free fringe benefits up to USD 8,380 per year;

- tax free allowances for the removal costs, the additional costs for housing in the first months and a rental car in the first months.

Additionally, the employer and employee can agree upon a net wage contract. The wage tax will then be calculated on the net wages and not be grossed up. Applying for the expatriate ruling can allow for a more competitive offering to potential candidates overseas.

Salary of the director-shareholder

Director-shareholders are obliged to take into account a fair market salary (in Dutch: “gebruikelijk loon”) for their services to the company in which they hold at least 5% of the shares.

The market salary should be determined by the highest of the following:

- 90% of the wages earned in the most comparable employment situation;

- the salary of the employee that earns the most without having shares in the company or if no employees are working in the company or affiliated entities 90% of the net turnover;

- twice the tax-free allowance as defined in article 24 of the Income Tax Act.

Please note that the legislation allows for a taxpayer to deviate from these conditions if the taxpayer can substantiate that the amount calculated above is higher than the 90% of the wages earned in the most comparable employed situation. In that case the lower amount may be taken into account. It is essential to ensure that the salary of the director-shareholder is accurately calculated and that any discrepancies from the rules above are adequately substantiated in writing.

In the proposed 2027 draft tax legislation it is suggested that the customary salary thresholds would be indexed annually using the standard correction factor for tax purposes. Employers should incorporate this indexation into compensation planning and payroll controls, if and once introduced.

If the partner of the director-shareholder is employed by the company or a group entity, the fair market rules apply to that partner as well. The partner is not required to be a director for the aforementioned rules to apply.

Reconciliation of wages

It is important to ensure that the wage tax summary and the wage costs in the annual accounts are reconciled and accounted for to avoid corrections and penalties in the future.

The current framework imposes enhanced further employee identification requirements and shifts the burden of proof to the employer where the employer knew or ought reasonably to have known that the identification documents were incorrect. In the event of inaccurate identification, the employee’s renumeration is assessed at the highest applicable income- and wage tax rates.

Final levy (in Dutch: eindheffing)

A final levy may apply where wage tax is borne at employer level – typically in situations where individualization of income components is impracticable – requiring gross-up of the relevant amounts. The final levy also extends to social-security and employer insurance contributions. Administratively, supporting tables are provided by the Tax Authorities. Please note that the application of the use of a final levy is subject to prior approval of the Tax Authorities.

Private use of company cars (proposed)

In the 2027 proposed tax legislation a final levy at employer level for the private use of company cars is introduced for situations in which a company car is used by two or more employees. If and when introduced, employers should assess fleet policies, data capture (e.g., mileage logs), and payroll settings to determine for which cars the final levy applies and whether the final-levy treatment is advantageous.

General Expenditure Tax

Refund of input ABB for manufacturers

The General Expenditure Tax (in Dutch: “Algemene Bestedingsbelasting”, hereinafter: “ABB”) allows for manufacturers to receive a refund of the ABB charged to them by other manufacturers or on import of goods when these goods are used by the manufacturer as raw materials or semi-finished products to produce their products.

Please note that refunds are only allowed if the invoices and import documents are prepared according to the prescribed format and the documents are available in the administration of the manufacturer. It is important to ensure all input ABB has been refunded.

Combination of services and supplies, what rate to apply?

A lot of services provided are a combination of supply of goods and provision of services. For instance, the repair of a boat demands goods as well as the installation of these goods, installing a new bathroom is a combination of supply of goods and services and even the delivery of food by restaurants is a combination of both supply of goods and services.

Since the supply of goods is only taxable when provided by a manufacturer, but taxed at a higher rate, it is important to verify whether the correct taxation of the combination of services and supplies has been applied and whether an entrepreneur should be considered a manufacturer.

While each component of a combined supply should ideally be considered on a standalone basis, even if the combination is charged in one price, the overall transaction may be taxed based on the predominant element if the average consumer cannot readily distinguish between the goods and services. The combination of supply of goods and services is closely related and both components do not have a purpose on their own. Therefore, it is essential to determine whether the provision of goods or services constitutes the primary component.

To avoid additional taxation at a later stage it is important to assess the tax returns for the application of all combinations of supply of goods and provision of services prior to the end of the year.

Refunds on ABB from bad debts and discounts

Please note that the ABB will be refunded upon invoices that are not (fully) paid and which will not be paid in full, as well as with regard to discounts provided on invoices.

It is important to check before the end of the year if a refund has been requested for all discounted invoices and bad debts.

Cost sharing agreements

The ABB legislation currently does not have the possibility for affiliated entities to join in a so-called fiscal unity to avoid ABB on intercompany transactions. However, when a group of affiliated companies have certain expenses that are incurred by one entity, but have been used by multiple entities, a cost sharing agreement may provide a solution to avoid ABB-taxation on intercompany transactions.

A cost sharing agreement is a pre-defined legal agreement that outlines how a group of entities will share the costs of shared services or intangibles. The allocation of costs is typically determined based on the utilization of these services by the participating entities. Since the allocation of the costs has to be pre-defined it is important to ensure that the agreement has been entered into and the allocation key has been provided for before the year-end.

Fiscal unity for General Expenditure Tax purposes (proposed)

A fiscal unity regime for ABB has been proposed in the 2027 draft tax legislation under which all entities included in an approved group would be treated as one single entrepreneur/producer for ABB purposes. Intercompany transactions within the fiscal unity would be disregarded for ABB.

Eligibility extends to an entrepreneur established in the BES who holds all shares – both its legal and economic title – in another BES entity. The draft legislation explicitly permits inclusion of more than one subsidiary and is understood to encompass lower-tier subsidiaries as well.

All members of the fiscal unity would be jointly and severally liable for the ABB assessed at the level of the holding entity or any other member. We will keep you updated if and when this proposed legislation will be introduced.

Small Business Exemption

The small business scheme is regulated in article 6.22 of the Tax Law BES. In short, the scheme means that the ‘small entrepreneur’ who is eligible for this scheme does not have to file an ABB return and does not have to pay the ABB in that year, the entrepreneur receives an exemption for this.

To be eligible for the small business schemes, the following conditions must be met (in short):

- the entrepreneur is a natural person and lives in the Caribbean Netherlands or is located in the Caribbean Netherlands or has a permanent establishment in the Caribbean Netherlands;

- the natural person in question is the owner of a company (sole proprietorship);

- the annual turnover does not exceed the threshold of USD 30,000,

- if the entrepreneur has more than one business or exercises more than one profession, the companies or professions will be taken into account jointly for the purpose of this regulation.

- the entrepreneur needs to provide periodic updates on their turnover to the tax authorities.

If during the calendar year the turnover threshold of USD 20,000 is exceeded, the ‘small entrepreneur’ is obliged to file and pay an ABB return for the amount due over that year, which needs to be filed with the first tax return in the year following the year the threshold is exceeded.

Farming exemptions (proposed)

It is proposed in the 2027 draft tax legislation that goods and machinery used in farming, which currently qualify for an exemption upon import, would likewise be exempt from ABB when produced within the BES.

In addition, it is proposed that the sale and purchase of agricultural land be exempt from Real Estate Transfer Tax, subject to a continuous use requirement of at least 10 years. If the use of land changes within these 10 years, the calculated tax will become payable. However, the exemption remains applicable if the change of the use of land is caused by changes in policy of the government with respect to these properties.

Personal Income Tax

Increase of the tax-free allowance for personal income tax

The tax-free allowance (In Dutch: “belastingvrije som”) is expressly indexed to the statutory minimum wage. For the 2025 tax year, the allowance is USD 21,373 (elderly supplement: USD 1,616). The allowance will adjust in line with any subsequent changes to the minimum wage.

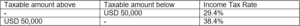

As part of purchasing-power measures for the BES islands, the government has proposed changes to the first two brackets of the income tax and wage tax, effective January 1, 2026, aimed at strengthening the position of lower- and middle-income groups. The reduction in the first bracket would be offset by an increase in the second bracket.

The proposed progressive income tax rates will be adjusted as follows:

The proposed legislation for 2027 introduces limited amendments to the personal income tax regime. First, it would eliminate the elective allocation of income components between spouses in the year of divorce, such that the mandatory allocation of specified income and costs applies in that year. Secondly, the proposed legislation allows for wording to further clarify the fact that the tax-free amount for personal income tax is determined on the basis of the minimum wage.

Main Residence

Effective 2025, the BES Income Tax Act refines the definition of “main residence” to require that the dwelling be primarily available to the taxpayer as a residence. The amendment is intended to preclude the deduction of mortgage interest on multiple properties within the Caribbean Netherlands.

For personal income tax purposes, interest on loans secured by the main residence are deductible up to USD 15,364 per year. In addition, premiums for fire and natural-disaster insurance and maintenance expenses are deductible up to USD 1,676 or 2% of the property’s value, as provided in the statute.

From a compliance and planning perspective, ensure timely documentation of primary availability and consider phasing eligible maintenance over multiple years to optimize the annual deduction ceilings.

Cost Deduction for Study and Children

The costs for study for a job and the costs for study and necessary cost of living for children can be deductible from the taxable income for personal income tax purposes.

It is important to not just keep the invoices of these costs, but also the proof of payment(s), since for deduction purposes you need to prove you have paid the expenses.

Real Estate Tax

The real estate tax rate for individuals and entities owning real property in the BES remains at 17.5%, calculated based on 4% of the property’s value. However, in the proposed legislation for 2027 the special tax rate for hotels owned by entities is proposed to be further increased from 11% to 12%.

Exemption for increase in value due to construction

Value increases attributable to construction, renovation, improvement, expansion or refurbishment qualify for a time-limited exemption from real estate taxation. For value increases realized up to and including December 31, 2024, the exemption applies for 10 years, commencing from the eleventh year after the increase occurred (in accordance with the statutory timing rule). For value increases realized on or after January 1, 2025, the exemption period is reduced to 5 years.

Formal tax legislation (proposed)

The 2027 tax legislation proposal clarifies when penalties may be imposed for failing to provide required information and the conditions that must be met before a penalty is charged, making enforcement more predictable. It would also allow a writ of execution (in Dutch: “betekening van een dwangschrift”) to be served by post, eliminating the need for personal delivery. Finally, the Tax Authorities would be empowered to stop vehicles identified as belonging to taxpayers with outstanding tax debts and impound them on the spot, subject to identification checks and standard procedural safeguards. We will keep you updated if and when this legislation is introduced.

Should you have any questions and/or remarks regarding the above, please feel free to contact us.

[1] Please note that we have also included the proposed measures in the Tax Plan 2026 as well as the proposed tax legislation 2027 in this tax alert. These are both still pending approvals and we will keep you updated once introduced.