Suriname – Wage tax changes by State Decree 22 July 2025

Suriname – Wage tax changes by State Decree 22 July 2025

July 24, 2025

In implementation of the Wage Tax Act (S.B. 1981 no. 181, as last amended by S.B. 2024 no.2), significant changes to the wage tax have been made. The relevant State Decree is a result of the Tripartite Agreement, and the agreements made with the joint trade unions.

The implementation of these changes is at the behest of the Minister of Finance and Planning and aims at a structural reduction of the tax pressure on wages.

Key changes summarized:

1. Increase of tax-free amounts for vacation pay and bonuses/gratuities

(With retroactive effect as of January 1st, 2025)

The tax-free amount for payments outside of regular wages – such as vacation pay, bonuses, and gratuities – has been increased from SRD 10,016 to SRD 19,500 per year.

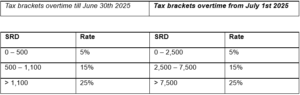

2. Revision of overtime tax brackets

(With retroactive effect as of July 1st, 2025)

The wage tax rates for overtime have been revised. The expansion of the tax brackets has led to a reduced tax burden on overtime compensation, making it more financially advantageous.

3. Mortgage interest deduction – increase of the maximum deductible mortgage debt – art. 18 par.1 sub g Income Tax Act 1922 (G.B. 1921 no. 112, as last amended by S.B. 2022 no.150)

(With retroactive effect from January 1, 2025)

The maximum mortgage debt for which interest deduction can be applied has been increased from SRD 600,000,- to SRD 871,500,-. We would like to point out that the mortgage interest deduction is regulated in the Income Tax Act 1922 and not in the Wage Tax Act.

Recommendations and points of attention:

- Employers are advised to timely adjust their payroll administration to this new legislation.

- Employees can expect a higher net salary due to the application of the increased exemptions and expansion of the tax brackets for overtime.

If you have questions or need further assistance, please feel free to contact our Tax Professionals. Our experts are happy to assist you and ensure that you are fully aware of the new rules and how they apply to your situation.