TAX CHANGES FOR INDIVIDUALS AND EMPLOYEES

TAX CHANGES FOR INDIVIDUALS AND EMPLOYEES

November 28, 2023

Dear Madam, Sir,

We would like to bring the following to your attention. After difficult negotiations between various unions and the government, the parties have reached agreements on several changes to the tax system.

General

On November 23rd, Ravaksur, BvL, ALS, FOLS, and the government reached a consensus on several tax measures. As part of this agreement, the parties agreed to amend the Wage and Income Tax Act. One significant aspect of this agreement is the adjustment of tax brackets within both acts. Although an official decree has not yet been issued, it is expected that changes will take effect as of January 2024. In line with this, the government has committed itself to implement the following modifications to the Income Tax Act and the Wage Tax Act:

Changes to the Personal Income Tax and the Wage Tax, that will probably take effect on January 1, 2024:

- The monthly tax-free sum of SRD 7.500 will increase to SRD 9.000.

- The tax deduction (tax deductible expenses) will increase from SRD 100 to SRD 400; and

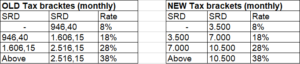

- The tax brackets will also be adjusted as follows:

As soon as we will receive the official publications, we will inform you thereof.

We will be happy to further assist you with the implementation of these changes. Feel free to reach out to us in case our assistance is required.